Fraud & Scam Alerts

Unfortunately scams have become a very common way to trick consumers into sharing private, personal information with fraudsters or send money to them. There are scams in just about every category...romance scams, car buying scams, fake check scams, job scams, gift card scams...the list goes on and on! We want to help provide you with resources and information so that you won't fall victim to scams.

Quick Links

Be Aware of Common Scams

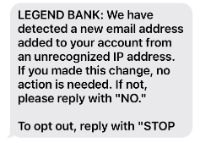

- Text Falsely Claiming to be from Legend Bank - Fraudulent text messages are circulating that falsely claim to be from Legend Bank, asking recipients to verify changes to personal information on their account. These messages are not from us—please do not respond or provide any personal contact information to the scammers. Check your account activity as well as your contact information by logging into your Online Banking account.

-

Phone Calls Falsely Claiming to be from Legend Bank - Beware of fraudsters spoofing our phone number and falsely claiming to be from Legend Bank’s Fraud Department. These scammers may attempt to verify account transactions or trick you into sharing sensitive information. If you receive a call like this, hang up immediately. Never share your account log-in credentials, password, account number, or any other personal information. To verify your account activity safely, use Legend Bank's Online Banking, log into our mobile app, or contact our Customer Care Agents at 800-873-5604 during business hours. Stay vigilant and protect your information.

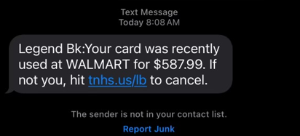

- Debit Card Fraud Alert Text - Scammers are sending texts claiming to be Legend Bank verifying a transaction with a link to click. If you receive a text message like this, don’t click the link! This is a scam. Remember, we will never ask you to click a link. Be diligent to protect your personal, private information. Never click links, give your account information or share your login and password. Keep your information private.

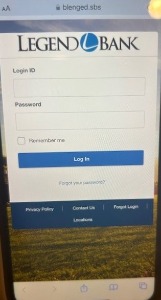

We have received reports that the scammers have created a copycat Legend Bank Mobile Banking login page to trick you into entering your login ID and password. If you clicked the link in the text, don't enter your information on this page. This is not a Legend Bank online or mobile banking login page. If you entered your information, please contact our Customer Care Agents at 800-873-5604 immediately so that we can assist you further.

We have received reports that the scammers have created a copycat Legend Bank Mobile Banking login page to trick you into entering your login ID and password. If you clicked the link in the text, don't enter your information on this page. This is not a Legend Bank online or mobile banking login page. If you entered your information, please contact our Customer Care Agents at 800-873-5604 immediately so that we can assist you further.

- Jugging - Be cautious when withdrawing large sums of cash from your bank or an ATM. Perpetrators are watching and will follow you to another location like the parking lot or your home, and rob you. Jugging often involves careful planning and surveillance by criminals who target unsuspecting individuals. Here are some tips to protect yourself from jugging from the Texas Bankers Association.

- BE AWARE:

Be mindful of your surroundings: When withdrawing money, be observant. Check if anyone is watching you. Also, do not use an ATM that is not working properly, even if minor. If you notice anyone

acting suspiciously or following you, leave the area. - CONCEAL YOUR CASH

Don't display your cash: After withdrawing cash, put it away immediately in your wallet or purse. Avoid counting it in public or travelling for an extended period. Never leave large sums of cash in your car. - BE DISCREET

Be discreet with your transaction: Dispose of your bank slip properly. If you are using an ATM, shield the keypad with your hand or body while entering your PIN. Make sure to take your card and transaction

receipt before leaving.

- BE AWARE:

- Job Scam - Who can resist a job where you can work from home, set your own hours or make a lot of money in a short amount of time. Scammers know this and post fake job ads to lure you in. They may try to charge you a fee to get started and then steal your personal information. Learn how to avoid a job scam in this article from the FTC.

- Unexpected Gift Scam - If you receive an unexpected gift with a note to scan a QR code to find out who sent it, it's a scam. This is a new twist on a brushing scam used to steal your personal information. You should always be cautious about entering your information on an unfamiliar website. To learn more about this type of scam from the FTC, click here.

- Unpaid Toll Scam - Scammers are pretending to be tolling agencies and sending out text messages demanding you pay your tolls or face consequences. It may have include a specific amount and a link that takes you to a page requesting your bank or credit card information. Don't click the link or respond to the text. Click here to learn more about this type of scam and what the FTC recommends to help keep you safe.

- Bitcoin ATM Scam - Did you get a call telling you it's urgent to move your money using a Bitcoin ATM to protect it? Scammers are notorious for using a scare tactic to get you to do what they want. If you are contacted by a random person pressuring you to move your money to keep it safe and to keep the transaction a secret, you should immediately hang-up and contact your financial institution. Learn more about this scam by reading this article from the FTC.

- Gift Card Scams - Gift cards are convenient for shoppers, but they are also a scammer's favorite way to steal your money. If someone contacts you and demands that you pay them with a gift card, for any reason, don't fall for it. Funds stolen from gift cards can't be recovered. Buy gift cards for gifts, not for payments.

- Charity Scams - Scammers may use recent national disasters and the holiday season as opportunities to steal funds from donors. If someone contacts you to ask for a charitable donation, research the charity. Make sure your donations goes where you want it to, not in the hands of a scammer.

- False Advertisement Scams - Social media platforms generate personalized ads for each individual user. Scammers use these ads to create "lookalike stores" to sell counterfeit products or perpetuate other scams. If it's too good to be true, it may likely be a scam. Also, don't click on online links as they may be a phishing scam. Verify the legitimacy of an online retailer by reading reviews about the seller.

- Delivery Problem Scams - Have you received an email or text stating that our package is undeliverable due to a missing or invalid address? You are instructed to click a link to update your information or the package will be returned to sender. This is a scam. During the holidays, scammers use this trick knowing that a lot of folks shop online and will fall victim to their notice. If you receive this notification, visit the website where you placed your order to confirm if there is truly a delivery issue.

- Jury Duty Scams - You may receive a call or text from someone claiming to be with your local law enforcement agency stating you have missed jury duty. They may be able to verify your name, address, and date of birth and tell you that you must pay a large fine to prevent having a warrant for your arrest issued. Or the email version may direct you to click a link that is malware and will infect our computer. Don't let the caller intimidate you and don't click on any links! Hang up or delete the email. The Better Business Bureau has some great tips on preventing the jury duty scam.

-

Text Message Scam - Receiving a text message from an unknown number might peak your curiosity so you respond to see if it's someone you know. Scammers use this tactic as a conversation starter to try to earn your trust. They may send you a link to click on or try to pressure you to send them money using a cash app or investing in cryptocurrency. The best way to handle this type of text is to simply not respond. To learn more about this type of scam and ways to avoid it, the FTC has provided helpful information.

- Pay Yourself Scam - This scam consist of receiving a call or text from someone pretending to be your bank stating you have a fraudulent transaction on your account that requires immediate action. The scammers convince you the only way to stop the transaction is to 'send yourself' money through a money transfer app. In reality, you have been tricked and are sending money to the scammers. The scammers are using their own phone numbers or email addresses to attach to your bank account and convince you they need the one-time passcode to verify your account. Once you give them that information, your funds will be going to the scammers and not you. Here's some tips to help avoid this scam:

- Never give out your account numbers, PINs, or other personal information with anyone who contacts you, even if they say they are calling from your bank.

- If the person calling, says there is an issue with your account and needs your account information, hang up and call your bank.

- Don't ever call the number in the text. Use the phone number you are familiar with to call your bank directly.

- Don't click on links in a text message from someone you don't know. The link may direct you to a fraudulent site or expose your device to malware.

- Your bank will never ask you to send money to yourself.

- Romance Scams - Romance scams are often initiated online and typically begin like any other online relationship: interested parties exchange basic information, where they work, where they live, hobbies and interests. Relationships may form very quickly with the scammer expressing their “love” early on, despite never meeting in person. Learn more with these resources from the FTC.

- Family Emergency Imposter Scam - You receive a phone call from a "family member" stating they are your child, grandchild or other close family. It's urgent that you send them money immediately or they will go to jail and you can't tell anyone. STOP! Don't send money until you speak to another family member that can verify this. Watch this short video for more tips from the FTC.

- Tech Support Scam - Have you received an unexpected call from a computer technician stating they are with a well-known company? They may tell you about viruses or malware on your computer and want remote access to your computer or insist you buy new software. Once you give them access, they are able to see everything on your computer including passwords. Hang up and don't allow them access to your computer. Read more about this scam and tips to avoid it from the FTC.

- Phone Number Spoofing - Scammers use caller ID spoofing to trick you into thinking they are calling from a local business or someone you trust. These scammers even spoof financial institution phone numbers and pretend to be bankers you know and trust. If you receive a call from a financial institution or one claiming to be from Legend Bank using our phone number, don’t give out or confirm any of your personal, private or financial information. Legend Bankers will never call you or email and ask you for this information. Click here for more tips and information from the Federal Trade Commission.

- Email Spoofing - Email spoofing is a technique used to trick you into thinking an email message came from someone you know and trust. In this type of scam, the sender forges email headers, contact information and email signatures, but they change some of the contact information. The email will look exactly like one you would expect from a colleague, company you work with or friend. The goal is to trick you into believing the email is legitimate so that you will follow through with their request.

Here are some tips to avoid this scam:-

Confirm the sender’s email address in the email is correct. It may only lookslightly different so be diligent in double checking.

-

Verify the information in the sender’s signature information is correct. Checkname spelling, phone number, email address and address.

-

Pause and consider the request in the email. Does it seem like a normal requestyou would receive from your contact or does it seem a little suspicious?

-

Send a new email or call the sender with the contact information you have to

-

- Unclaimed Tax Return Scam -If you receive a cardboard envelope from a delivery service sent by the IRS, it’s most likely a scam. The letter enclosed has contact information and a phone number that doesn’t belong to the IRS and asks for sensitive personal information from taxpayers for an unclaimed tax return. You should always be wary of any request asking you to email or call a number to give financial or personal information.

Click here to learn more about this scam.

- Phishing Scams - Every day, thousands of people fall victim to phishing scams. Phishing is a type of scam where criminals make fraudulent emails, phone calls and texts that appear to come from a legitimate bank.

- Banks Never Ask That - Check out our Banks Never Ask That page for tips and videos so that you can know what questions we aren't going to ask to protect yourself and your information.

- How to Recognize and Avoid Phishing Scams - The Federal Trade Commission (FTC) provides a lot of resources to help you recognize these scams and what to do next. Click here to learn more.

- Banks Never Ask That - Check out our Banks Never Ask That page for tips and videos so that you can know what questions we aren't going to ask to protect yourself and your information.

-

Money Laundering Scams - Scammers are using threatening and intimidating tactics to accuse you, your spouse or your bank of money laundering. They ask for money to help clear your name or to help them catch your bank. If you receive a call like this, it’s a scam.

To avoid these types of scams:-

Never talk with someone you don't know about where you bank.

-

Don't give cash to someone you don't know that is demanding you pay them.

-

Be careful of scare tactics to cause you to take immediate action because of fear.

-

Know that you won't be contacted with claims about your bank participating in money laundering. Banks are heavily regulated and government agencies would contact the bank directly if there are any concerns.

-

Don't trust unknown callers. Hang up and immediately contact local law enforcement and your bank to make them aware of the calls. Click here to learn more about this scam.

-

- Amazon Imposter Scams - The FTC recently shared tips to spot Amazon imposter scams and how to protect yourself. In these scams, "Amazon" contacts you to confirm that you didn't make a recent purchase or talk with you about your account being compromised. There are several versions of these scams. Here are some tips from the FTC on how to avoid these scams:

-

Never call back an unknown number. Use the information on Amazon’s website and not a number listed in an unexpected email or text.

-

Don’t pay for anything with a gift card. Gift cards are for gifts. If anyone asks you to pay with a gift card – or buy gift cards for anything other than a gift, it’s a scam.

-

Don’t give remote access to someone who contacts you unexpectedly. This gives scammers easy access to your personal and financial information—like access to your bank accounts.

Click here to learn more about this scam.

Click here to learn more from the FTC.

-

- Fraud Department Imposters - Scammers are sending texts and calling customers posing as our fraud department, disguising their caller ID to make it look like it's coming from the Legend Bank Customer Care phone number (800-873-5604). If you get a call requesting your online banking login ID and password, don't share it, even if the caller says they are verifying fraudulent transactions on your account. Learn More About This Scam

- Social Security Scams - The FTC has provided these tips about scams where people pretend to be from the Social Security Administration trying to get your number and even your money!

- IRS Scams - IRS imposter scams are becoming a popular ways to scare consumers into making payments. Learn more from the FTC.

-

Fake Check Scams - Fake checks are used in a variety of scams, for example if you are told you won a big prize or you are offered a mystery job opportunity, you could be a victim of a fake check scam. Scammers continue to trick consumers into sending them money through these scams. Learn more about these scams and how to avoid them by clicking here.

-

Online Security - Protect your computer and online files from the bad guys with these tips from the FTC.

Tips for Avoiding Scams

- Guard your personal information. Don't offer your personal information unless you have confirmed that a request is legitimate. Scammers engineer methods to entice you to share your personal and financial information.

- Slow Down! Scammers create a false sense of urgency to get you to act quickly. I you are asked to act quickly, or there is an "emergency", it may be a scam. End your conversation and research the business they claim to be calling from.

- Use caution when shopping online. Verify that the website you are using is legitimate and safe before you use your card to pay.

- Use strong passwords. use different usernames and passwords for all financial accounts and online shopping portals. Choose passwords that are not easy to guess. Most legitimate sites and apps require passwords that contain a combination of letters, numbers and symbols.

- Verify before donating. Before making a charitable contribution, research the charity using these organizations: Better Business Bureau (BBB), Wise Giving Alliance, Candid, Charity Navigator, and Charity Watch. donate directly to a verified charity rather than through someone that claims to be an intermediary. Be cautions of organizations with names that are similar to reputable charities.

Scammers are very creative in the tactics they use to get you to give them what they are asking for. According to the FTC, if you are told any of the following, it's most likely a scam.

- "Act now!" Scammers use pressure, so you don't have time to think. But pressuring you to act now is always a sign of a scam. It's also a reason to stop.

- "Only say what I tell you to say." The minute someone tells you to lie to anyone including your bank tellers or investment brokers, stop.

- "Don't trust anyone. They're in on it." Scammers want to cut you off from anyone who might slow you down. Stop!

- "Do [this] or you'll be arrested." Any threat like this is a lie. Nobody needs money or information to keep you out of jail, keep you from being deported, or avoid bigger fines. They are all scams.

- "Don't hang up." If someone wants to keep you on the phone while you go withdraw or transfer money, buy gift cards, or anything else they're asking you to do, that's a scammer. DO hang up.

- "Move your money to protect it." Nobody legit will tell you to transfer or withdraw your money from your bank or investment accounts.

- "Withdraw money and buy gold bars." This is a scam always, every time.

- "Go to a Bitcoin ATM." Nobody legit will ever insist you get cryptocurrency of any kind. And there's no legit reason for someone to send you to a Bitcoin ATM.

- "Buy gift cards." There is never a reason to pay for anything with a gift card. Once you share the PIN numbers on the back, it's the same as handing them cash...it's gone.

Resources

- Avoiding and Reporting Scams - The Federal Trade Commission (FTC) has lots of resources to help you learn how to avoid scams, determine what to do if you were scammed and how to report scams. Learn more by visiting the FTC website.

- Banks Never Ask That - Check out these videos, scam quiz, FAQs, scam red flags, clues and more. Click here to visit our Banks Never Ask That page.

Account Notification Services

We encourage you to use the following services on your account so that you can be notified about transactions on your account:

- Card Control - Know where and when your card is being used and protect it by turning it off if you suspect fraud or if you lose your card. Learn more about Card Control.

- Account Alerts - We encourage you to set up account alerts so that you'll be notified when transactions occur on your account. Once you are logged in to Online Banking you can set up the following types of account alerts:

- Security Alerts

- Account Alerts

- History Alerts

- Online Transaction Alerts

- Reminder Alerts

You can also determine how you'd like to receive your alerts:

-

- Phone Call

- Text Message

- Secure Message in Online Banking

To learn more about setting up alerts, please watch our how-to video.

Stop Identity Theft

Identity theft occurs when someone uses your personal information such as your name, Social Security number, credit card number, debit card number and PIN or other identifying information without your permission to commit fraud or other crimes.

To prevent being a victim of identity theft:

- Don't give out private, personal information to someone you don't know or to someone contacting you directly asking for this information

- Review your bills and statements on a regular basis

- Guard your mail and trash from theft

- Shred items that contain personal information

- Report lost or stolen checks or credit cards immediately

Reporting and Recovering from ID Theft

- Report identity theft and get a recovery plan from the FTC's site IdentityTheft.gov.

- Learn more about how to protect your identity, what to do if there's a data breach as well as get access to free resources to help at the FTC's Recovering from Identity Theft site.